Example of appeal letter to insurance company is crucial for navigating insurance claim denials. This guide breaks down the process, from understanding policy specifics to crafting a compelling argument, ensuring you get the payout you deserve. Learn how to structure a persuasive appeal letter, tailored to different claim types, while maintaining a professional tone.

Successfully appealing an insurance claim requires careful preparation and a well-structured letter. Understanding your policy, gathering supporting documentation, and presenting a strong case are essential steps. This comprehensive guide walks you through each stage, providing examples and strategies to maximize your chances of success.

Introduction to Appeal Letters

An appeal letter to an insurance company is, essentially, a polite but firm plea for reconsideration of a claim denial. It’s not just a whiny letter; it’s a strategically crafted argument, presented with the utmost clarity and tact, to persuade the insurance company that their initial decision was flawed. Think of it as a persuasive essay, but instead of arguing about the merits of Shakespeare, you’re arguing about the merits of your damaged car or medical bills.The purpose of this letter is not to start a shouting match, but to present a compelling case for why the original decision should be reversed.

The goal is to demonstrate that the insurance company’s previous evaluation was incomplete or inaccurate, thereby justifying a fresh look at the claim. Ultimately, the appeal aims to secure a favorable resolution that aligns with the insured’s rightful compensation.

Definition and Purpose of Appeal Letters

An appeal letter is a formal written request to an insurance company, submitted after a claim has been denied. It Artikels the reasons why the initial decision was incorrect, providing supporting evidence and a rationale for a favorable outcome. The goal is to convince the insurance company that their previous assessment was inaccurate or incomplete.

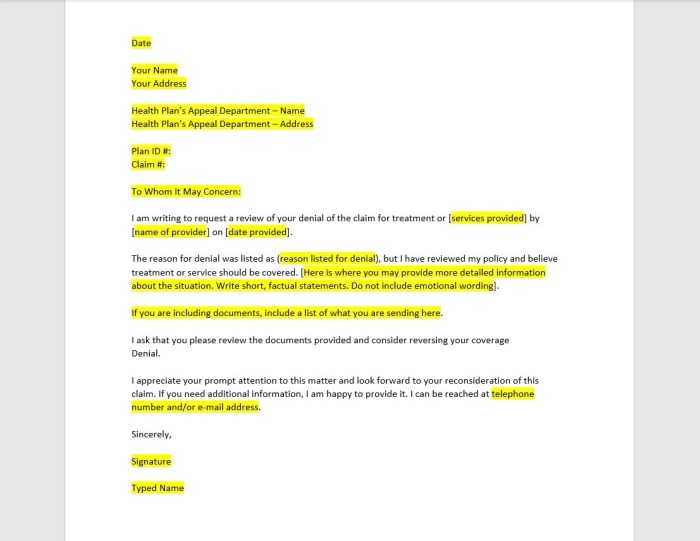

Typical Components of an Effective Appeal Letter

A well-structured appeal letter typically includes a clear and concise introduction, a detailed explanation of the claim, supporting evidence, and a persuasive closing.

- Introduction: Briefly restate the claim and the reason for the denial. This is your hook, setting the stage for your argument. Clearly state the desired outcome.

- Detailed Explanation of the Claim: Thoroughly describe the events leading up to the claim, emphasizing any crucial details that the insurance company may have overlooked. Use clear, specific language and avoid ambiguity.

- Supporting Evidence: This is where the rubber meets the road. Provide all relevant documentation, such as receipts, photos, medical reports, or witness statements, to back up your assertions. Be organized and use bullet points to highlight key pieces of evidence.

- Persuasive Closing: Summarize your arguments and reiterate the desired outcome. Express your confidence that the insurance company will reconsider their decision in light of the presented evidence. A polite, yet firm tone is essential.

Importance of Clear and Concise Language

Clarity is paramount in an appeal letter. Jargon or convoluted language can confuse the insurance company and diminish your chances of success. Use simple, direct language, and avoid emotional appeals unless absolutely necessary. Focus on presenting the facts logically and persuasively.

Comparison of Appeal Letters for Different Insurance Claims

| Claim Type | Key Considerations | Supporting Evidence Examples ||—|—|—|| Property Damage | Extent of damage, proof of ownership, repair estimates, photos of the damage | Insurance policy, appraisals, receipts for repairs, photographs of the damage || Medical Expenses | Proof of medical treatment, bills, doctor’s notes, justification for expenses | Medical bills, doctor’s notes, treatment plans, receipts for medications || Liability Claims | Evidence of negligence, documentation of damages, witness statements | Police reports, accident reports, witness statements, photos of the scene, medical bills of injured parties || Life Insurance | Validity of the policy, proof of death, beneficiary information | Death certificate, policy documents, beneficiary designations |

Understanding Insurance Policies

Insurance policies, those seemingly impenetrable documents, are actually blueprints for your financial safety. They lay out the rules of the game, the boundaries of your protection, and the potential pitfalls. Understanding these policies isn’t just about avoiding trouble; it’s about making sure your appeal is rock-solid, built on a foundation of knowledge. Knowing the ins and outs of your policy is your secret weapon in the insurance jungle.Navigating these policies can feel like deciphering ancient hieroglyphics, but fear not, intrepid policy-seeker! This section will demystify the process, breaking down policy language and highlighting key differences between various types.

We’ll also illuminate the importance of understanding exclusions and limitations, equipping you with the knowledge to craft a compelling appeal.

Reviewing Policy Terms and Conditions

Thoroughly reviewing your insurance policy is crucial. This involves careful scrutiny of every clause, every sentence, and every seemingly insignificant detail. It’s like dissecting a fly – the more you look, the more you find! Look for specific details about the coverage, the procedures for filing a claim, and the time limits for appeals. This process is not just about finding loopholes; it’s about understanding your rights and responsibilities under the agreement.

Policy Language and the Appeal Process

The language used in insurance policies can be dense and technical. This is where the true challenge lies. Precise wording often determines the outcome of a claim. Words like “accidental,” “intentional,” or “negligence” can drastically alter the interpretation of events and thus the outcome of your appeal. Precise understanding of these terms is crucial to avoid misinterpretations and ensure your appeal is well-founded.

It’s like learning a new language – the language of insurance.

Types of Insurance Policies

Insurance comes in various flavors, each designed to protect different aspects of your life. Homeowners insurance, for example, protects your house from fire, theft, and other disasters. Auto insurance shields you from accidents and damages to your vehicle. Health insurance, on the other hand, covers medical expenses. Each policy has its own specific terms and conditions, exclusions, and limitations.

Importance of Understanding Policy Exclusions and Limitations

Insurance policies, while offering protection, aren’t magical shields. They have exclusions and limitations, defining what theywon’t* cover. These exclusions and limitations are often buried within the fine print. Failing to understand them can lead to a rejected claim, and an appeal based on misinformation. Think of them as the hidden obstacles in your insurance journey.

Common Insurance Policy Exclusions

Understanding exclusions is critical for a successful appeal. Below is a table outlining common exclusions. It’s important to remember that this is not an exhaustive list, and specific exclusions vary by insurer and policy. Be sure to consult your policy for a complete list of exclusions.

| Type of Insurance | Common Exclusions |

|---|---|

| Homeowners | Earthquake damage, flood damage, intentional damage, wear and tear |

| Auto | Damage caused by war, intentional acts, use for illegal activities, pre-existing damage |

| Health | Pre-existing conditions, cosmetic procedures, experimental treatments, certain types of mental health care |

Documenting the Claim

Dude, claiming something from an insurance company is like trying to solve a mystery novel. You need all the clues, all the evidence, to prove your case. And the best way to do that? Documenting your claim meticulously. Think of it as leaving a trail of breadcrumbs for the insurance investigator.

Each piece of evidence is a breadcrumb, guiding them towards the truth.Effective documentation isn’t just about collecting stuff; it’s about presenting it in a way that screams, “This is important! This is my claim!” Think of it like a detective’s notebook—organized, clear, and compelling. The more organized your evidence, the easier it is for the insurance company to understand your situation and approve your claim.

This is crucial, because a messy presentation can make them think you’re trying to pull a fast one.

Supporting Documents Needed

Collecting evidence is like assembling a puzzle. Each piece, whether it’s a photo, a receipt, or a medical record, contributes to the complete picture. The more complete the picture, the stronger your claim.

- Proof of Loss: This could be a police report, a damage assessment, or even a detailed account of the incident, ideally with timestamps. If you’re claiming for medical expenses, your medical bills are your best friend. Be sure to include the dates, amounts, and diagnosis. And don’t forget about any follow-up appointments.

- Policy Details: Your insurance policy is the contract that Artikels the terms of your coverage. Make sure to have a copy handy; it’s your bible of rights and responsibilities. Include policy numbers and any relevant endorsements.

- Receipts and Invoices: For any expenses you’re claiming, receipts are your golden tickets. They prove you actually incurred the costs. Include details like dates, amounts, and descriptions. Don’t forget the vendor’s name and contact information.

- Photos and Videos: Visual evidence is often irrefutable. Photos of the damage, injuries, or the scene of the accident can be powerful evidence. Make sure the photos are clear and well-lit. Videos can provide even more detail and context.

- Medical Records: For health-related claims, your medical records are vital. Include reports from doctors, hospitals, and other healthcare providers. Dates, diagnoses, and treatments are all critical components.

Organizing and Presenting Evidence

A well-organized presentation of evidence is key to a successful appeal. Think of it like presenting a compelling story. Each piece of evidence needs to fit into the narrative and support your claim.

- Chronological Order: Arrange your documents in the order they occurred. This helps tell a clear story of events. Start with the initial incident and then follow the timeline.

- Clear Labeling: Label each document with a brief description, and include the date it was created or received. This helps ensure the documents are easily understandable and verifiable.

- Formatting: For photos and documents, make sure they’re easy to read and understand. Avoid blurry or poorly-lit photos. Ensure your documents are clear, concise, and easy to read. Number pages for clarity.

Accurate and Complete Documentation

Accurate and complete documentation is paramount to a successful appeal. This is your chance to present your side of the story clearly and persuasively. Anything missing or inaccurate could weaken your case.

| Document Type | Relevance to Claim |

|---|---|

| Police Report | Proof of incident, details of accident |

| Medical Bills | Proof of medical expenses incurred |

| Receipts for Repairs | Proof of property damage repair costs |

| Photos of Damage | Visual evidence of the extent of the damage |

| Witness Statements | Independent accounts of the incident |

Constructing a Compelling Argument

Alright, so you’ve got your ducks in a row, documented your claim, and now it’s time to craft an appeal that’ll make the insurance company sit up and take notice. Think of this as your chance to be a persuasive storyteller, painting a picture of your situation that resonates with their logic and, hopefully, their empathy. It’s not just about stating facts; it’s about weaving a compelling narrative that showcases your case’s strength.The key to a successful appeal is pinpointing the precise reason for your dissatisfaction.

It’s like finding the single, most important ingredient in a dish. If you’re vague, your appeal risks getting lost in the bureaucratic maze. Be crystal clear about what part of the initial claim process you’re challenging and why. Did they misinterpret the policy? Were there errors in their assessment?

Knowing the specific point of contention makes your argument laser-focused.

Identifying the Specific Reason for the Appeal

Clearly identifying the specific reason for the appeal is paramount for a successful outcome. A well-defined reason allows the insurance company to pinpoint the precise area needing reconsideration. Vague appeals are likely to be dismissed. Specificity is your best friend in this scenario.

When crafting an appeal letter to an insurance company, it’s crucial to clearly articulate the reasons for your claim and support them with evidence. This process can be quite challenging, but focusing on the specific details of your situation can be helpful. Finding the perfect pizza for a meal in Destin, FL can be equally daunting; thankfully, a quick search reveals some great options, like the ones found on this page: best pizza in destin fl.

Regardless of the situation, careful planning and a well-structured appeal letter are essential for a successful outcome.

Strategies for Presenting a Strong Case for Reconsideration

Presenting a strong case involves more than just reciting facts. You need to show, not just tell. This means supporting your claims with concrete evidence. Quotes from policy documents, supporting documents, witness statements, and even photos can significantly bolster your case. Use these to paint a vivid picture of your situation.

Show, don’t just tell.

Detailing the Process for Identifying and Addressing the Insurance Company’s Objections

Understanding the insurance company’s objections is crucial. Thoroughly reviewing their initial denial letter is the first step. Look for the specific points they raise. Are there any factual inaccuracies? Have they misinterpreted any clauses in the policy?

Once you’ve identified the objections, craft a precise response to each one. Address their concerns point by point. Remember, each response should be supported by evidence.

Framing the Appeal to Emphasize the Claimant’s Perspective

Frame your appeal from your perspective. Avoid sounding accusatory or overly emotional. Instead, focus on presenting your situation objectively and rationally. Highlight the specific impacts the claim denial has had on you. Show them how the denial has affected you and why a reconsideration is necessary.

Paint a picture of your situation without resorting to accusations.

Common Insurance Company Objections and Strategies to Address Them

- Policy Exclusions: Insurance policies often have clauses that exclude coverage for certain events. If the insurance company cites an exclusion, thoroughly examine the policy’s language. Look for any ambiguities or instances where the situation might fall outside the exclusion’s scope. Highlight the specific aspects that don’t fit the exclusion criteria.

- Insufficient Evidence: The insurance company might argue that the evidence you provided wasn’t enough to support your claim. In such cases, present additional documentation to bolster your case. If possible, gather further evidence to demonstrate the validity of your claim.

- Fraudulent Activity: In some instances, insurance companies might suspect fraudulent activity. If this is the case, you need to address these allegations directly and transparently. Clearly explain the events surrounding your claim, and provide documentation to refute any suspicions.

Addressing these common objections head-on is crucial. These are like common obstacles in a quest, and knowing how to tackle them can make your appeal more effective. By preparing to meet these objections, you’ll be better equipped to navigate the appeal process.

Addressing Specific Claim Types

Insurance claims, like tiny little dragons, can be tricky to tame. Each type—homeowners, auto, health—has its own unique quirks, and fighting a denied claim feels like battling a bureaucratic beast. But fear not, fellow claim-fighters! This section dives deep into the specifics of appealing different insurance claim types, giving you the tools to craft a compelling case and hopefully win back what’s rightfully yours.Navigating the world of insurance appeals requires a keen understanding of the specific policy language and the procedures unique to each type of claim.

A well-structured appeal letter, tailored to the specific claim type, significantly increases your chances of success. Let’s explore how to tailor your appeal to each situation.

Appealing a Denied Homeowners Insurance Claim

Homeowners insurance, like a cozy blanket on a cold night, protects your investment. When a claim is denied, it’s a slap in the face, especially when dealing with damage like a leaky roof or a windstorm. Focus on meticulously documenting the damage, providing detailed photos and videos, and ensuring your documentation is impeccable. This often involves working with contractors and getting professional appraisals.

When crafting an appeal letter to an insurance company, it’s crucial to clearly articulate the reasons for your claim. Understanding the nuances of your situation and the specifics of the policy are key, much like navigating a menu, such as Fat Jack’s pizza menu. This careful consideration will ultimately strengthen your position and increase your chances of a favorable outcome, ultimately assisting you in getting the support you need.

Thoroughly review your policy to understand your coverage limits and exclusions. Did you have enough coverage for the incident? Were there any specific clauses in the policy that might have played a role in the denial? Highlighting any discrepancies in the claims assessment or in your policy’s wording is key.

Appealing a Denied Auto Insurance Claim

Auto insurance claims are like navigating a maze. There are so many factors involved, from the accident itself to the police report, and you need to be meticulous. If a claim is denied, carefully examine the denial letter. Identify any discrepancies or missing information that might have led to the denial. If there were injuries, make sure medical documentation is impeccable.

Did you follow the proper procedures for reporting the accident? Consider contacting the insurance company’s adjustor for clarification. If the adjuster’s explanation doesn’t satisfy you, consider consulting with a lawyer. Their expertise in navigating the legal complexities of insurance claims can be invaluable.

Appealing a Denied Health Insurance Claim

Health insurance claims, like a fragile lifeline, are crucial for navigating the healthcare system. Navigating the complexities of medical bills and insurance coverage can feel like climbing Mount Everest. To appeal a denied claim, present comprehensive medical documentation, including doctor’s notes, lab results, and diagnoses. Carefully review the denial letter. It should Artikel the reasons for denial.

If the reason is a pre-existing condition, be ready to provide documentation that proves the condition is now in remission. Highlighting any misinterpretations of the medical documentation or policy provisions is crucial.

Tailoring the Appeal to the Specific Claim Type

Crafting an effective appeal letter requires a deep understanding of your specific insurance policy and the circumstances surrounding the claim. Each claim type, whether for a home, a car, or your health, presents unique challenges and opportunities. Thoroughly review the policy’s terms and conditions, paying particular attention to the details that may have led to the denial. If the denial was based on insufficient evidence, gather additional documentation.

If the denial was based on a policy exclusion, demonstrate how the circumstances don’t fall under that exclusion. Demonstrate a clear understanding of your policy and the insurance company’s position.

Table Summarizing Common Claim Types and Recommended Approaches for Appeal Letters

| Claim Type | Recommended Approach |

|---|---|

| Homeowners | Thorough documentation of damage, professional appraisals, policy review. |

| Auto | Review denial letter, examine police reports, medical documentation, and contact the adjuster. |

| Health | Comprehensive medical documentation, review denial letter, highlight any misinterpretations. |

Strategies for Effective Communication

Hey, fellow appeal letter writers! Crafting a compelling appeal letter isn’t just about the words; it’s about thedelivery*. Think of it like sending a love letter—you want it to reach the right person, at the right time, with the right message. Just as a poorly-delivered love letter might get lost in the mail or end up in the wrong hands, a poorly-communicated appeal letter can easily get lost in the insurance company’s bureaucratic labyrinth.

So, let’s get strategic!Effective communication in an appeal is key to getting your claim heard and, hopefully, settled. The right approach ensures your letter isn’t just read, butunderstood* and, ultimately, acted upon. We’ll dive into methods for ensuring your letter lands in the right hands, how to follow up effectively, and why timely and clear communication is crucial.

Ensuring Proper Recipient

To guarantee your appeal letter reaches the correct department, meticulously research the insurance company’s internal structure. Don’t just aim for a generic “Claims Department.” Identify the specific team or individual responsible for handling appeals related to your claim type. This could be a dedicated appeals unit, a senior claims adjuster, or even a specific email address. Using the correct contact information prevents your letter from getting lost in the shuffle.

For example, if you’re appealing a denied home insurance claim, look for the “Homeowners Appeal Unit” instead of a general email.

Following Up Effectively

Following up is crucial, not just for your claim, but also for your sanity. A polite follow-up email or phone call (after a reasonable timeframe, of course) can help ensure your appeal letter isn’t overlooked. Keep it concise and professional, reiterating the key points of your appeal and asking for an update on the status of your claim.

Avoid being overly aggressive or demanding; a friendly reminder is more effective. Remember, you’re trying to have a productive conversation, not a shouting match. Avoid sending multiple follow-up emails in a short period; that might come off as spam.

Importance of Timely Communication

Time is of the essence in the appeal process. Insurance companies have deadlines for responding to appeals. Missing these deadlines could result in your appeal being deemed untimely and potentially dismissed. Staying organized and keeping track of deadlines is crucial. Knowing the timeline for your specific insurance company and claim type will be invaluable.

A proactive approach, like checking the company’s website for appeal procedures or directly contacting the claim department, will help you avoid any delays.

Importance of Clear and Concise Communication

Craft your appeal letter with clarity and conciseness. Avoid jargon or overly complex language that might confuse the recipient. Focus on presenting your case in a logical and easy-to-understand manner. Clearly state the issue, the relevant policy provisions, the supporting evidence, and your desired outcome. Use bullet points or numbered lists to highlight key arguments.

This will make your letter more easily digestible and increase the chances of it being understood correctly. This is your chance to present a solid argument, so avoid ambiguity and unnecessary words.

Timeline for Appeal Process Stages

| Stage | Description | Estimated Timeframe (in business days) |

|---|---|---|

| Submitting Appeal | Submitting your appeal letter to the appropriate department. | 1-3 |

| Initial Review | The insurance company reviews your appeal. | 5-10 |

| Response from Reviewer | The company provides feedback or a decision on your appeal. | 7-14 |

| Further Action (if needed) | If the response is unsatisfactory, you can take further actions. | Variable, depending on the complexity of the appeal. |

This table provides a general guideline. Actual timelines may vary based on the insurance company and the specific circumstances of your claim. It’s essential to check the insurance company’s policies for their specific timelines.

Understanding Appeal Outcomes

Appealing an insurance claim denial can feel like navigating a labyrinth, but understanding the possible outcomes is crucial for a smooth (and hopefully successful) journey. It’s not about blindly hoping for the best, but strategically preparing for different scenarios. Just like a novel, every story has a plot twist, and sometimes, that twist involves a rejection. Knowing the potential turns helps you plan your next move.The insurance company’s decision on your appeal isn’t arbitrary; it’s based on the policy, your claim, and the evidence you’ve presented.

Understanding the process of handling those decisions and possible resolutions will be your compass in this adventure.

Potential Appeal Outcomes

Appeals aren’t always a guaranteed win. There are various possible outcomes, ranging from a complete reversal of the initial denial to a complete rejection of your appeal. Understanding these possibilities will help you set realistic expectations. Think of it as a game of poker; you need to know the odds before betting your chips.

- Favorable Decision: The insurance company reverses the denial, acknowledging the validity of your claim and providing the benefits you initially sought. This is the ideal outcome, but not always the case.

- Partial Approval: The insurance company agrees with some aspects of your claim but not all. This might involve covering part of the requested amount or acknowledging some of the damages. This is a mixed bag, requiring careful review of the terms.

- Complete Denial: The insurance company upholds its initial denial. This is the most frustrating scenario, but remember, it’s not the end of the road.

- Conditional Approval: The insurance company might approve your claim under certain conditions, such as providing further documentation or undergoing a medical examination. This is like a mini-challenge; fulfilling these conditions is vital.

Handling Decisions and Responses

The insurance company will usually provide a written response to your appeal. Review it meticulously, highlighting the reasons for their decision. This response is your blueprint for your next steps. Don’t just read it; dissect it.

- Review the Response Carefully: Look for any specific reasons why your appeal was denied. This is crucial for your next move.

- Identify Areas for Improvement: Was there something you could have done better to present your case? Identifying these gaps will help you strategize.

- Understand the Timeline: The response will often Artikel the next steps and potential timelines for a resolution. If you’re unsure, contact the insurance company to confirm the next steps.

Approaching a Denied Appeal and Further Steps, Example of appeal letter to insurance company

A denied appeal can feel discouraging, but it’s essential to approach it strategically. It’s not the end of the world, just a turning point. You’ve got options.

- Negotiation Strategies: Explore if there’s room for negotiation. Could you compromise on some aspects of your claim in exchange for a partial resolution? Think of this as a negotiation, not surrender.

- Gathering Additional Evidence: Could there be missing documentation or evidence that could strengthen your appeal? Gathering new supporting documents might just be the key.

- Seeking Legal Counsel: If you feel the insurance company’s decision is unjust, consider seeking advice from a lawyer specializing in insurance claims. A legal expert might help you navigate the complex legal procedures.

Legal Recourse

If all else fails, and you feel the insurance company’s decision is unjust or violates your rights, you may have legal recourse. Don’t be afraid to explore your options.

- Contact a Legal Professional: A lawyer specializing in insurance disputes can assess the situation and advise you on your options. This is a crucial step.

- File a Complaint: Depending on the jurisdiction, you might be able to file a formal complaint with a regulatory body overseeing insurance companies. This can be a powerful tool.

- Seek Mediation or Arbitration: These alternative dispute resolution methods might offer a quicker and less expensive way to resolve the issue than going to court. These might be a good option to explore.

Closing Summary

In conclusion, appealing an insurance claim effectively demands a deep understanding of your policy, meticulous documentation, and a persuasive argument. By following the strategies Artikeld in this guide, you can significantly increase your chances of a successful appeal. Remember to maintain a professional tone throughout the process, and be prepared for potential outcomes. This guide equips you with the knowledge and tools to navigate the appeal process with confidence.

FAQ Summary: Example Of Appeal Letter To Insurance Company

What if my appeal is denied?

If your appeal is denied, review the response carefully. It might Artikel reasons for the denial. Consider further steps, such as negotiating a resolution or exploring legal options.

How long does the appeal process typically take?

The timeframe varies based on the insurance company and the complexity of the claim. Refer to your policy or contact the insurance company for specific timelines.

What if I don’t have all the required documents?

Contact the insurance company to request any missing documentation as soon as possible. Expedited processing may be available.

Can I use a template for my appeal letter?

While templates can be helpful, tailor the letter to your specific situation and evidence. A generic template might not highlight your unique case effectively.