Chase vs Bank of America for international students, a weighty decision fraught with implications for financial well-being. Navigating the complex world of international banking can feel daunting, especially for those adjusting to a new country and educational environment. Choosing the right bank can impact everything from tuition payments to everyday expenses, making informed comparisons crucial. This exploration delves into the specifics of each institution, comparing account types, fees, and services tailored to the unique needs of international students.

International students often face challenges in securing reliable banking solutions that meet their specific needs. This analysis explores the nuances of both Chase and Bank of America, offering a detailed comparison for international students seeking the best fit. Understanding the advantages and disadvantages of each bank is key to making an informed choice that supports a smooth and financially secure experience during their studies.

Introduction to International Student Banking Options

Navigating the financial landscape as an international student can be daunting. Understanding the available banking options and the specific challenges international students face is crucial for managing finances effectively. From opening accounts to managing transactions, the right banking solution can significantly impact your student experience.International students often encounter unique obstacles when choosing a bank. These include the need for international accounts that support multiple currencies, the potential for unfamiliar fees and transaction limits, and the difficulty in understanding local banking regulations.

Furthermore, maintaining a strong credit history while studying abroad can be challenging and often requires a bank that understands the specific financial needs of students.

Available Banking Options for International Students

International students have a variety of banking options, including international student accounts specifically designed for their needs, local bank accounts in the host country, and online banks with global reach. The best choice depends on individual circumstances and preferences. Each option presents its own set of benefits and drawbacks, and students should carefully weigh these factors.

Common Challenges Faced by International Students

Several challenges often complicate the bank selection process for international students. These include the need to meet specific account requirements (like providing proof of enrollment or residence), the complexity of international transaction fees, and the potential for difficulties in accessing services outside the home country. Furthermore, understanding and adhering to local banking regulations in the host country is crucial for avoiding unnecessary complications.

So, like, Chase vs Bank of America for international students? It’s all a bit of a faff, tbh. You gotta weigh up the interest rates and fees, which can be a right pain in the backside. Plus, finding out where to buy cotton candy flavouring for your next epic baking sesh is also crucial. Check out this site for all the deets: where to buy cotton candy flavoring.

Ultimately, it’s all about finding the best deal for your specific needs, which is basically the same deal with picking the right bank, you know?

Comparison of Chase and Bank of America for International Students

Choosing between Chase and Bank of America, or any bank, requires careful consideration of specific account types, fees, and services offered. The following table highlights key differences relevant to international students:

| Feature | Chase | Bank of America |

|---|---|---|

| Account Types | Offers various accounts, including checking, savings, and potentially international student accounts. Details may vary by location. | Similar range of account types, including checking, savings, and possibly international accounts. Specific features might differ depending on the location. |

| Fees | Transaction fees, international transfer fees, and maintenance fees can vary. Students should review the fee schedule carefully to avoid surprises. | Transaction fees, international transfer fees, and maintenance fees can vary. Students should review the fee schedule carefully to avoid surprises. |

| Services | May provide services such as online banking, mobile banking, and international money transfers. The level of support for international transactions should be considered. | Offers similar services like online banking, mobile banking, and international money transfers. The extent of support for international transactions needs to be examined. |

| Additional Considerations | Review specific branch locations and their accessibility, along with potential restrictions or requirements for international students. | Evaluate the accessibility of branch locations and potential restrictions or requirements for international students. |

International students should thoroughly research the specifics of each bank to determine which best meets their needs and budget. A well-researched decision can save significant time and potential financial headaches.

Chase Bank for International Students

Chase Bank, a major US financial institution, offers various banking products and services tailored for international students. Understanding these options is crucial for managing finances effectively during your studies in the US. This section details Chase’s specific offerings, account opening procedures, transaction support, and fees, along with a comparison to other options.Chase provides a range of banking services specifically designed for international students, addressing their unique financial needs while studying in the US.

These services include accounts, credit cards, and support for international transactions.

Chase’s International Student Banking Products and Services

Chase offers checking accounts, savings accounts, and potentially specialized student accounts, designed to accommodate international students’ financial requirements. The bank also provides services like international money transfers and currency exchange, crucial for students remitting funds to their home countries. These products and services can vary depending on individual circumstances and eligibility criteria.

Chase’s Account Opening Process for International Students

The account opening process for international students at Chase typically involves providing documentation such as a passport, visa, and proof of enrollment at a US institution. International students often need to complete a specific application form, providing personal details, financial information, and supporting documents. The process can be completed online or in person, with varying requirements and timeframes.

Chase’s Support for International Transactions and Currency Exchange

Chase facilitates international transactions, including money transfers, and offers currency exchange services. This support is crucial for students sending money home or receiving funds from abroad. The bank’s fees and exchange rates for international transactions are an important consideration for students. Students should carefully review the terms and conditions of any international transaction services.

Chase’s Fee Structure for International Students

Chase’s fee structure for international students may include account maintenance fees, international transaction fees, and ATM withdrawal fees. Students should review the fee schedule carefully to understand the potential costs associated with using Chase’s services. Fees can vary depending on the specific account type and usage patterns.

Comparison of Chase’s ATM Network Globally

Chase’s ATM network is extensive within the US but may be less extensive in other countries. Students should consider the availability of Chase ATMs in their home countries or countries they may visit, and alternative options such as partnering banks or international ATM networks if needed. This aspect is important for withdrawing cash during travel or emergencies.

Chase’s Online and Mobile Banking Accessibility for International Students

Chase’s online and mobile banking platforms provide convenient access to account information, transactions, and financial management tools. International students can access their accounts, monitor transactions, and manage their finances remotely. Accessibility to these services can significantly improve financial management and control for students.

Common Concerns or Complaints about Chase for International Students

Some international students have reported difficulties with account opening, documentation requirements, or the complexity of international transaction procedures. Others have expressed concerns about the clarity of fees associated with international services or the availability of Chase ATMs in certain regions. Thorough research and review of the bank’s terms and conditions are essential for international students considering using Chase for their banking needs.

Bank of America for International Students

Bank of America, a major US financial institution, offers a range of banking products and services designed for international students. Understanding these options is crucial for navigating the financial landscape while studying abroad. This section delves into Bank of America’s offerings, focusing on account opening, international transactions, fees, ATM access, and online/mobile banking.Bank of America caters to the specific needs of international students, providing services that streamline financial management during their academic pursuits.

So, like, Chase vs Bank of America for international students is a real conundrum, right? Finding the best bank for your student needs is crucial, especially when you’re looking at houses for sale in St Joseph County MI, like these beauties. You gotta weigh up the fees and stuff, but ultimately, the best bank depends on your specific situation.

Still, a good bank is essential for a smooth move, you know?

This includes considerations for international transactions, currency exchange, and fee structures, all of which are crucial for students living and studying in the United States.

Bank of America’s International Student Banking Products and Services

Bank of America offers various accounts for international students, including checking and savings accounts. These accounts often come with features tailored to meet the unique financial needs of students. The specific products available may differ based on the student’s individual circumstances and the location of their bank branch.

Bank of America’s Account Opening Process for International Students

The account opening process for international students at Bank of America typically requires documentation verification. This usually involves presenting valid student visas, proof of enrollment, and proof of address. The specific requirements may vary based on individual circumstances. It’s essential to contact Bank of America directly for the most up-to-date and accurate information.

Bank of America’s Support for International Transactions and Currency Exchange

Bank of America facilitates international transactions, although the specific terms and conditions can vary. The bank offers currency exchange services to handle transactions involving foreign currencies. International transaction fees may apply, and students should review the fee schedule carefully.

Bank of America’s Fee Structure for International Students

Bank of America’s fee structure for international students includes various charges. These may encompass account maintenance fees, ATM withdrawal fees (domestic and international), and international transaction fees. Students should carefully review the fee schedule before opening an account to understand the associated costs.

Comparison of Bank of America’s ATM Network Globally

Bank of America maintains a global ATM network, which may offer ATM access to international students in various locations worldwide. However, the availability and terms of ATM use may vary by location and student’s account type.

Bank of America’s Online and Mobile Banking Accessibility for International Students

Bank of America’s online and mobile banking platforms are generally accessible to international students. These platforms allow for managing accounts, transferring funds, and conducting other financial transactions remotely.

Comparison of Account Features Between Chase and Bank of America

| Feature | Chase | Bank of America |

|---|---|---|

| Account Types | Checking, Savings, Money Market | Checking, Savings, Money Market |

| International Transaction Fees | May apply, specific details vary | May apply, specific details vary |

| ATM Access | Extensive global network | Extensive global network |

| Online/Mobile Banking | User-friendly platform | User-friendly platform |

| Account Opening Requirements | Generally straightforward | Generally straightforward |

Comparing Chase and Bank of America for International Students

Choosing the right bank is crucial for international students navigating the complexities of a new financial environment. Both Chase and Bank of America offer services tailored to international students, but key differences in fees, accessibility, and overall experience can significantly impact a student’s financial well-being. Understanding these nuances is vital for making an informed decision.A comprehensive comparison allows international students to evaluate which bank best aligns with their individual needs and circumstances.

Factors like the frequency of international transactions, the requirement for specific services, and the overall banking experience should be considered when making a choice. A careful evaluation of the offerings from both banks can help students make the most effective financial decisions.

Key Differences in Services

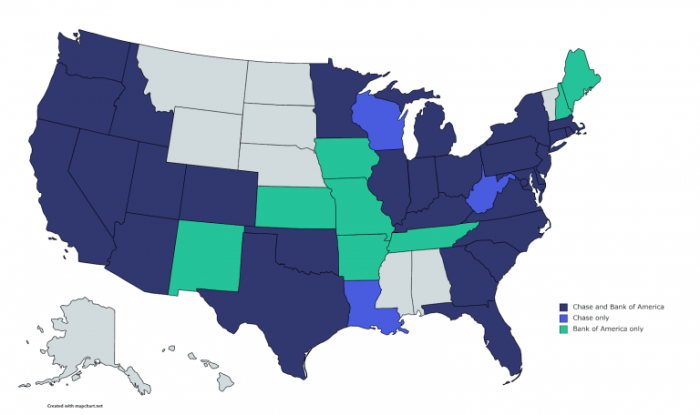

Both Chase and Bank of America offer international student accounts, but their services differ in several key aspects. Chase emphasizes digital banking tools, while Bank of America often provides more traditional banking options. International students should evaluate their preference for digital platforms versus in-person interactions when considering these differences. This assessment will help them determine which bank’s service model better suits their lifestyle and needs.

Fees and Accessibility

International students need to understand the varying fees associated with each bank. Chase often charges lower fees for international transactions, making it a more attractive option for students frequently sending or receiving money abroad. Bank of America, on the other hand, might offer a wider range of in-person banking services, which can be beneficial for students who prefer face-to-face interactions.

However, the fees for international transactions may be higher.

Pros and Cons of Each Bank

| Feature | Chase | Bank of America |

|---|---|---|

| Pros | Lower fees for international transactions, robust digital platform, generally easier online account management. | Wider range of in-person banking services, potentially more familiar banking options for students accustomed to traditional approaches. |

| Cons | Limited in-person branch network compared to Bank of America, potentially less familiarity with the specific banking needs of international students. | Higher fees for international transactions, may require more extensive paperwork for account opening. |

Support Systems for International Students

Both banks offer support for international students, but the level and accessibility of that support can vary. Chase often emphasizes digital support channels, such as FAQs and online chat, while Bank of America might provide more readily available in-person assistance at their branches. International students should assess the level of support they need and choose the bank that offers the most suitable support system.

A robust support network is essential for navigating the unique challenges of banking as an international student.

Evaluating the Best Bank for Individual Needs

International students should consider several factors when evaluating which bank is best for them. Factors such as the frequency of international transactions, the preference for digital or in-person banking, and the specific requirements of their student visa should be considered. These factors play a crucial role in making the most appropriate choice.

Additional Considerations for International Students

Navigating the complexities of international banking can be daunting for students. Beyond comparing specific bank offerings, a crucial aspect involves understanding the nuances of local regulations and potential risks associated with international accounts. This section delves into key considerations that international students should take into account when selecting a banking partner.

Researching Local Banking Regulations

International students often find themselves operating within a new financial landscape. Thorough research into local banking regulations is paramount. Understanding these regulations helps international students avoid potential issues, such as compliance problems or restrictions on account usage. This includes comprehending local requirements for opening and maintaining accounts, as well as restrictions on currency exchange or international money transfers.

Failing to comply with local regulations can lead to penalties or account closures.

Benefits of Understanding Specific Banking Options

Awareness of banking options tailored to the location of study yields significant advantages. These options can often provide tailored services and lower fees for international students. Understanding these offerings enables students to make informed decisions that best suit their needs and financial situation. For instance, some banks might offer specialized services for international students, like simplified account opening procedures or international money transfer discounts.

Checking Fees and Regulations for International Accounts

International student accounts often come with specific fees and regulations that differ from domestic accounts. It is essential to meticulously review these fees, including account maintenance fees, transaction fees, and international transfer fees. Furthermore, international students should be aware of any restrictions on account usage, such as limits on withdrawals or restrictions on specific types of transactions. A thorough examination of these details is crucial for effective financial management.

Identifying Potential Risks Associated with International Banking

International banking carries inherent risks that international students need to understand. These risks can include currency fluctuations, transaction delays, and security concerns related to international money transfers. For instance, currency exchange rates can impact the value of international remittances or funds sent home. Furthermore, delays in international transfers can create financial hardships, especially for students reliant on regular support.

Reliable Alternative Banking Options

Various alternative banking options can provide international students with reliable and convenient solutions. These may include digital wallets, peer-to-peer (P2P) payment platforms, or international remittance services. These platforms offer streamlined processes for international transactions, often with lower fees and faster transfer times compared to traditional banking methods. Examples of these platforms include Wise, TransferWise, and similar services specifically designed for international money transfers.

Table Summarizing Important Considerations

| Category | Description |

|---|---|

| Local Regulations | Thoroughly research and understand local banking regulations for account opening, usage, and currency exchange. |

| Specific Banking Options | Identify and leverage banking options tailored to the location of study, potentially offering specific services for international students. |

| Fees and Regulations | Carefully review fees associated with international accounts, including account maintenance, transaction, and international transfer fees. |

| Potential Risks | Be aware of risks such as currency fluctuations, transaction delays, and security concerns related to international money transfers. |

| Alternative Options | Explore digital wallets, P2P platforms, or international remittance services for streamlined and potentially more affordable international transactions. |

Case Studies (Illustrative Examples): Chase Vs Bank Of America For International Students

International students face unique financial challenges, requiring careful consideration of banking options. Understanding how other students have navigated these choices through practical case studies provides valuable insights. This section presents illustrative examples of successful financial management using both Chase and Bank of America, highlighting positive experiences and potential hurdles.Successfully managing finances is crucial for international students, especially considering the complexities of international transactions, currency exchange, and maintaining a strong credit history.

These case studies offer valuable lessons for students facing similar situations, illustrating how specific banking solutions can address these challenges.

Chase Bank for International Students: A Successful Scenario, Chase vs bank of america for international students

A Chinese student, Anya, enrolled in a US university, chose Chase for her banking needs. She found Chase’s mobile app intuitive and user-friendly, allowing her to easily track expenses and manage her budget. Anya appreciated Chase’s international money transfer services, which allowed her to send and receive funds to and from her family back home without incurring excessive fees.

She utilized Chase’s online banking tools to track her spending and income and set up automatic payments for rent and tuition. Anya’s positive experience with Chase highlighted the bank’s accessibility and helpful customer service.

Bank of America for International Students: A Different Approach

Another international student, David, an Indian student, found Bank of America’s international banking services to be a viable option. He appreciated Bank of America’s extensive branch network, allowing him to readily address banking needs in person, particularly for in-depth inquiries and financial planning. David chose Bank of America for its straightforward account opening process, despite the initial paperwork.

He successfully used Bank of America’s online tools to monitor his account balance and manage international transfers. David’s experience demonstrated the value of a robust branch network for international students requiring face-to-face assistance.

Comparative Analysis of Success Rates

Unfortunately, quantifiable data on success rates for international students with Chase and Bank of America is not readily available. Success rates depend on individual circumstances, including financial habits, proficiency in English, and understanding of banking procedures. While anecdotal evidence suggests both banks cater to international students, there are nuances in their services and offerings. For example, Chase’s mobile-first approach may be preferred by tech-savvy students, while Bank of America’s branch network might be more beneficial for those seeking in-person assistance.

Further research is needed to create a comprehensive comparative analysis.

Positive Experiences with Chase

Students often praise Chase’s mobile banking platform for its ease of use, particularly the features allowing for international money transfers. A key benefit is Chase’s clear and transparent fee structure, which helps international students budget accordingly. They often highlight the user-friendly interface for managing budgets and transactions. Furthermore, many international students report positive experiences with Chase’s customer support, with helpful representatives readily addressing their concerns.

Positive Experiences with Bank of America

Bank of America’s extensive branch network proves helpful for students needing in-person assistance, especially for tasks requiring clarification or guidance. Many appreciate the straightforward account opening process, which allows for a quick setup, despite potential paperwork. Furthermore, the bank’s international money transfer services are often seen as reliable. A noteworthy benefit is the bank’s ability to offer a wide array of financial products and services, catering to different needs.

Challenges Faced by International Students

International students often face challenges with understanding local banking regulations and procedures, navigating complex forms, and maintaining accurate financial records. Language barriers can also pose a significant hurdle, while the high cost of international transactions can be a substantial concern. Furthermore, establishing credit history can be difficult for students who have not lived in the country for an extended period.

These factors can create significant financial strain.

Solutions Offered by Each Bank

Chase offers solutions like international money transfer services, clear fee structures, and a user-friendly mobile banking platform. Bank of America addresses these challenges through its comprehensive branch network, in-person assistance, and straightforward account opening processes. Both banks provide online resources and tools to help international students understand banking procedures.

Last Recap

In conclusion, the optimal bank for international students hinges on individual circumstances. While both Chase and Bank of America offer valuable services, evaluating factors like fees, transaction support, and accessibility is critical. Consider your specific financial needs, location, and anticipated usage patterns to determine which bank best aligns with your aspirations and realities. Ultimately, meticulous research and careful consideration will empower international students to make the most advantageous financial choices for their academic journeys.

FAQ Resource

What are the common challenges international students face when choosing a bank?

International students often face challenges with understanding local banking regulations, navigating international transactions, and managing currency exchange rates. Furthermore, account opening processes can be complex, and fees associated with international accounts can vary significantly. A reliable bank that offers seamless international transactions and clear fee structures is vital for international students.

What are some alternative banking options for international students?

Alternative options include online banks, specialized international student banking services, and even using existing accounts in their home country cautiously, if feasible. However, research is key to ensuring any alternative meets international student requirements and regulations, while considering fees, accessibility, and overall reliability.

What is the importance of researching local banking regulations?

Understanding local banking regulations is crucial to avoid potential issues. Different countries have varying requirements for international accounts, and fees or restrictions might apply. International students need to ensure the bank they choose adheres to all applicable regulations to avoid complications or unexpected costs.

How can international students evaluate the best bank for their needs?

International students should thoroughly evaluate banks based on their specific needs, including transaction fees, currency exchange rates, ATM access, account opening processes, and online/mobile banking accessibility. Comparative analysis of different banks’ services and fee structures is essential.