P&C insurance exam prep is a journey demanding meticulous planning and focused effort. This comprehensive guide will illuminate the path to success, equipping you with the tools and strategies needed to navigate the complexities of the exam. From understanding the exam structure and content to mastering effective learning strategies, this resource will be your steadfast companion throughout the preparation process.

A detailed breakdown of the exam syllabus, valuable study materials, and practical tips for time management and organization are provided to enhance your preparation.

By meticulously studying the key concepts, applying effective learning strategies, and practicing with mock exams, you’ll gain a profound understanding of property and casualty insurance principles. This in-depth exploration will help you develop the necessary skills and confidence to ace the exam. This is more than just an exam; it’s a gateway to a rewarding career in the insurance industry.

Exam Structure and Content

Nih, siap-siap buat ngerjain ujian P&C insurance! Ini breakdown-nya, biar lo pada ga bingung. Kita bahas detail struktur ujian, materinya, dan pentingnya tiap topik. Siap-siap nge-zoom ke detail, bro!The P&C insurance exam is structured to test your understanding of core principles and specific applications within the field. Knowing the exam structure and topic weightage is key to effective study planning.

This will help you allocate your time efficiently and focus on high-impact areas.

Exam Syllabus Breakdown

The syllabus typically covers a broad range of topics, from fundamental concepts to practical applications in property, casualty, and liability insurance. Understanding these areas is crucial for success.

- Fundamentals of Insurance: This section lays the groundwork for understanding insurance principles. It covers the nature of risk, the role of insurance in managing risk, different types of insurance, and essential concepts like insurable interest, peril, and indemnity. Understanding these basics is essential for tackling more complex topics later on.

- Property Insurance: This section delves into the specifics of insuring property. Topics include coverage for various types of property, determining values, understanding different types of policies (e.g., dwelling, commercial), and the importance of endorsements. This is a critical area that requires a good grasp of the nuances of property insurance.

- Casualty Insurance: This area focuses on insurance related to accidents and liabilities. You’ll learn about various types of casualty insurance policies (e.g., auto, workers’ compensation, general liability), coverage, claims procedures, and the legal aspects of liability. Understanding the legal ramifications and complexities of casualty claims is important.

- Liability Insurance: This part explores the intricacies of liability insurance. Topics include various types of liability policies (e.g., professional liability, product liability), the scope of coverage, and the legal responsibilities of insurers and insured parties. This area emphasizes the importance of risk assessment and prevention.

- Reinsurance: This area covers the mechanisms used by insurers to transfer risk to other insurers. It covers different types of reinsurance treaties and the processes involved. Understanding this topic is important for grasping the complex financial aspects of the insurance industry.

- Claims Management: This section details the procedures for handling claims, including investigation, assessment, settlement, and dispute resolution. It’s vital for understanding the practical side of insurance operations.

- Legal and Regulatory Framework: This section covers the legal and regulatory environment surrounding insurance operations, including the roles of regulatory bodies and the legal principles governing insurance contracts. Understanding this area is crucial for navigating the complexities of the industry.

Topic Weightage

This table provides a general idea of the relative importance of each topic area in the exam. Remember, this is just a guideline, and specific weights may vary depending on the exam provider.

| Topic Area | Estimated Weightage (%) |

|---|---|

| Fundamentals of Insurance | 15-20% |

| Property Insurance | 15-20% |

| Casualty Insurance | 20-25% |

| Liability Insurance | 15-20% |

| Reinsurance | 10-15% |

| Claims Management | 10-15% |

| Legal and Regulatory Framework | 5-10% |

Study Resources and Materials

Nih, buat persiapan ujian P&C insurance, sumber belajar itu penting banget, ga cuma buku doang, ada banyak banget pilihan. Dari yang cetak sampe online, semuanya bisa bantu. Kita bahas sekarang gimana cara milih yang tepat biar ga buang-buang waktu dan tenaga.Different study materials offer varying levels of detail and support. Choosing the right resources can significantly impact your exam prep journey.

This section will guide you through the options, highlighting their strengths and weaknesses.

Types of Study Guides and Textbooks

Various study guides cater to different learning styles. Some are concise, summarizing key concepts, while others are more detailed, providing in-depth explanations. Textbooks are generally comprehensive, but they might be too dense for some. The choice depends on your personal learning preferences.

Online Resources

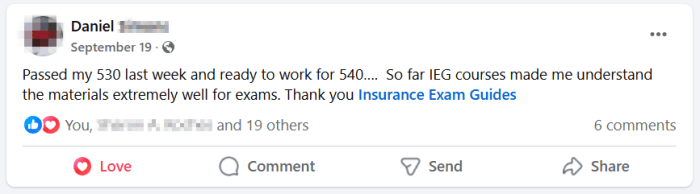

The internet is a goldmine for P&C insurance exam prep. Websites, forums, and online courses offer a wealth of information, practice questions, and even mock exams. Some resources are free, while others might require a subscription. The variety is massive!

Practice Questions and Mock Exams

Practice questions and mock exams are crucial for exam preparation. They help you identify areas where you need to focus your study efforts. Try to simulate the exam environment as closely as possible. This will help you manage your time effectively and build your confidence. Solving these questions consistently will help you recognize your weaknesses and reinforce your strengths.

Top 5 Resources for P&C Insurance Exam Prep

| Resource | Pros | Cons |

|---|---|---|

| Insurance Institute of America (IIA) Study Materials | Comprehensive coverage, industry-recognized, often includes practice questions and quizzes. | Can be expensive, might not be tailored to every learning style. |

| American Institute for Chartered Property Casualty Underwriters (AICPCU) Study Materials | Detailed explanations, strong emphasis on practical applications, frequently updated. | Some find the materials dense, might require significant time commitment. |

| Online Courses (e.g., Udemy, Coursera) | Flexible learning, often interactive, wide range of instructors and course styles. | Quality varies, might require self-discipline to stay on track. |

| Practice Question Banks (e.g., Kaplan, McGraw-Hill) | Targeted practice, helps identify knowledge gaps, boosts confidence. | May not provide in-depth explanations, might require additional resources for clarification. |

| Exam Review Books (e.g., from major publishing houses) | Concise summaries of key concepts, great for quick revision. | Might not cover all aspects of the syllabus, might not be as detailed as textbooks. |

Effective Learning Strategies: P&c Insurance Exam Prep

Hey, so you’re tryna ace that P&C insurance exam? It’s a tough nut to crack, but with the right strategies, you can totally crush it. We’re gonna dive into some serious learning techniques to help you memorize those complex terms and apply the principles like a pro. Let’s get this bread!Effective learning ain’t just about cramming, it’s about understanding the material and connecting the dots.

You gotta find methods that work foryour* brain, not just some generic study guide. Think of it like building a strong foundation – each strategy is a brick, and together, they create a solid structure for your knowledge.

Cracking the P&C insurance exam requires focused study, but a comfortable living space can also contribute to success. Finding a suitable 1 bedroom apartment for rent in Lynn MA, like the ones listed here , can help you concentrate on your studies without the stress of a complicated housing search. Ultimately, a well-organized study environment is key to passing your P&C insurance exam.

Memorizing Complex Insurance Terms and Concepts

To nail down those tricky insurance terms, try the “visual-verbal” method. Create flashcards with the term on one side and a visual representation or a simple definition on the other. For example, “Act of God” could have a lightning bolt graphic and a brief description. This combines visual and verbal cues, making recall easier. Also, try using mnemonics – catchy phrases or acronyms to remember key details.

Think “PIP” (Personal Injury Protection) – maybe you visualize a person getting a personal injury payout.

Understanding and Applying Insurance Principles

Insurance principles aren’t just abstract ideas; they’re the bedrock of the entire industry. To truly understand them, apply them to real-world scenarios. Imagine a scenario where a client files a claim. How would the principles of indemnity, utmost good faith, and insurable interest apply? This active application solidifies your grasp on the concepts.

Staying Motivated and Focused During the Study Process

Studying for an exam can be a grind, but motivation is key. Break down your study sessions into manageable chunks. Instead of marathon sessions, try shorter, focused intervals with mini-breaks in between. Reward yourself after each successful study session. Maybe a tasty snack or a quick game session.

These little rewards keep you motivated and prevent burnout. Also, create a study space that’s dedicated and conducive to focus.

Creating Personalized Study Schedules

A personalized schedule is your secret weapon for staying on track. First, analyze the exam syllabus and identify your weak points. Allocate more time to those areas needing more attention. Use a planner or digital calendar to schedule specific study blocks for each topic. For example, you could dedicate Monday to fire insurance and Tuesday to health insurance.

Also, incorporate buffer time for unexpected events. Don’t forget to schedule regular breaks to recharge. Finally, review your schedule frequently and adjust as needed. This is not a one-size-fits-all, you gotta tailor it to your learning style.

Practice and Mock Exams

Nah, belajar P&C insurance exam mah gak cukup cuma baca buku doang. Kuy, kita bahas pentingnya latihan soal dan simulasi ujian! Ini bakal jadi kunci biar lo pada lancar pas hari H.Practice questions dan mock exams itu kayak simulasi perang. Lo bisa ngelatih kemampuan, nemuin kelemahan, dan belajar strategi menghadapi soal-soal yang tricky. Ini penting banget buat ngebangun kepercayaan diri dan meminimalisir stress pas hari H.

Significance of Practice Questions and Mock Exams

Practice questions and mock exams are crucial for success. They help you identify areas needing more attention, refine your approach to different question types, and build confidence. This is especially useful in a high-pressure environment like an exam. Regular practice is a must.

Utilizing Practice Questions for Identifying Weak Areas

Practice questions are like a magnifying glass. They expose your weaknesses. By analyzing your mistakes, you can pinpoint the specific areas where you need to strengthen your understanding. Review the explanations carefully. This helps in a better comprehension of the concepts and formula involved.

Strategies for Taking Mock Exams Under Timed Conditions

Taking mock exams under timed conditions is crucial. This simulates the real exam environment, helping you manage your time effectively. Practice time management strategies, like allocating specific time for each section, are vital. Also, develop a consistent approach for each type of question.

Types of Practice Questions and Their Usefulness

| Type of Question | Usefulness |

|---|---|

| Multiple Choice | Excellent for assessing knowledge of key concepts and terms. Practice with this type is super important! |

| Scenario-Based | Helps apply theoretical knowledge to real-world situations. This is super crucial for understanding the practical application of concepts. |

| Calculation-Based | Tests understanding of formulas and calculations. Regular practice is vital to master these calculations. |

| Short Answer | Assesses your ability to synthesize information and express your understanding concisely. |

| Essay Questions | Tests in-depth knowledge and analytical skills. These questions are like a test of your critical thinking. |

Time Management and Organization

Woi, siap-siap nih buat nge-deal sama ujian P&C! Kalo ga jago manage waktu, bisa-bisa keteter, deh. Kita bakal bahas pentingnya manajemen waktu dan cara ngatur materi belajar buat nge-boost persiapan ujian. Yuk, simak!Effective time management is crucial for success in any exam, especially the P&C insurance one. Proper planning and organization are key to staying focused and avoiding procrastination.

This section will guide you on how to optimize your study schedule and maximize your learning efficiency.

Importance of Effective Time Management

Effective time management during the study process is essential for success in the P&C insurance exam. It allows you to cover all the necessary topics, review materials thoroughly, and practice enough to build confidence. Without a proper schedule, you might feel overwhelmed and lose focus, hindering your overall performance.

Strategies for Organizing Study Materials

Creating a well-organized system for your study materials is crucial. This helps you find information quickly and efficiently, minimizing wasted time. Consider these strategies:

- Categorize and Label: Group similar topics together and label each folder or notebook clearly. Use color-coding or stickers for visual aids. For example, create folders for different types of insurance policies (life, health, property), or for different exam sections.

- Create a Digital Library: Use cloud storage or a dedicated folder on your computer to store notes, practice questions, and other study materials. This makes accessing them easier and keeps everything in one place.

- Use Index Cards: For key formulas, definitions, or concepts, write them on index cards for quick review and memorization. This is especially helpful for concepts that need repetitive review.

Creating a Study Schedule

A study schedule acts as a roadmap, helping you stay on track and meet your exam goals. A well-structured schedule also prevents procrastination and ensures you cover all the essential topics.

- Realistic Goals: Don’t try to cram everything into one day. Break down the study material into manageable chunks and allocate time for each topic based on its complexity and your learning pace.

- Time Blocking: Schedule specific time slots for different subjects or topics. For example, dedicate an hour for property insurance, followed by half an hour for practice questions. This method keeps you focused and avoids getting distracted.

- Flexibility is Key: Life happens! Build in some flexibility into your schedule. If something unexpected comes up, you can adjust your schedule without feeling too stressed. Don’t be afraid to change your schedule, but try to maintain a reasonable balance.

Prioritizing Tasks and Managing Study Time Efficiently

Prioritizing tasks helps you focus on the most important topics first, maximizing your study time. Using effective time management techniques is crucial for achieving your goals.

- Prioritize by Importance and Urgency: Use a prioritization matrix (e.g., Eisenhower Matrix) to categorize tasks based on their importance and urgency. Focus on high-priority tasks first, and delegate or eliminate less critical ones.

- Timeboxing: Allocate specific time blocks for particular tasks, like studying a specific chapter or practicing mock exams. This helps maintain focus and avoid getting sidetracked.

- Pomodoro Technique: Work in focused intervals (e.g., 25 minutes) followed by short breaks. This technique can boost concentration and prevent burnout.

Sample Weekly Study Schedule for P&C Insurance Exam Prep

| Day | Time | Topic/Activity | Approach |

|---|---|---|---|

| Monday | 9:00-10:00 | Property Insurance | Review key concepts and definitions |

| Monday | 10:00-11:00 | Practice Questions | Focus on property insurance-related questions |

| Tuesday | 9:00-10:00 | Liability Insurance | Deep dive into the types of coverage and examples |

| Tuesday | 10:00-11:00 | Mock Exam | Simulate the exam environment and time constraints |

| Wednesday | 9:00-12:00 | Review all covered topics | Review notes, key points, and formulas |

| Thursday | 9:00-10:00 | Health Insurance | Focus on specific policy details and procedures |

| Friday | 9:00-11:00 | Comprehensive Review | Go over all the important points and review the most challenging areas |

Common Mistakes and How to Avoid Them

Wah, preparing for the P&C insurance exam is a tough nut to crack, right? Many peeps make common errors that can really mess up their scores. This section breaks down those typical blunders and gives you tips on how to avoid ’em. So, let’s get this bread!Understanding insurance concepts is key, but sometimes, the terminology and nuances can trip you up.

This section will highlight those tricky areas and provide strategies for getting a grip on the material. Learning how to tackle the exam’s format and common pitfalls is just as important as mastering the subject matter.

Typical Mistakes in Understanding Insurance Concepts

Understanding the specifics of insurance policies and various coverages is crucial. A common error is misinterpreting policy exclusions or conditions. For example, if a policy excludes damage caused by floods, it’s easy to overlook that detail and think the policy covers everything. This can lead to misunderstandings and incorrect answers. Knowing the exact language of the policy and the fine print is essential for avoiding these types of mistakes.

- Misunderstanding policy wording: Pay close attention to the exact wording of policies, especially exclusions and limitations. Carefully read and reread policy documents to fully grasp their meaning. Don’t just skim through them; dig deep to uncover the nuances.

- Confusing different types of insurance: Property and casualty, life, health, and other types of insurance can have overlapping concepts. Differentiating between these policies is essential for accuracy in your answers. Study the distinct characteristics of each type of insurance.

- Ignoring the details of risk assessment: Failing to comprehend risk assessment and the calculation of premiums can lead to errors in analyzing insurance situations. Be sure to understand the methodologies behind these calculations and factors involved.

Strategies for Overcoming Challenges During the Exam

The exam format can also cause problems. Time management is crucial, and rushing through questions can lead to mistakes. Planning your time and sticking to a schedule will help you avoid this common pitfall. Reviewing your answers and understanding why you made certain choices is just as important as getting the right answer.

- Efficient Time Management: Allocate specific time for each section. Practice timed mock exams to improve your speed and accuracy. If you’re struggling with a particular question, move on and come back to it later.

- Accurate Review and Analysis: After each section or mock exam, take time to review your answers. Understand why you got a question right or wrong. Identifying your weaknesses will help you focus your study efforts.

- Understanding Exam Structure: Familiarize yourself with the exam format and the types of questions asked. This will help you approach each question with a strategic mindset.

Example of Typical Errors in Understanding Insurance Concepts

A common mistake is not fully grasping the concept of insurable interest. A person who does not have a financial stake in the item being insured may not be able to collect if something happens to it. For example, if you don’t own a car, you can’t claim damages on it. The exam might present a scenario where this concept is tested.

- Inadequate understanding of insurable interest: Ensure you grasp the concept of insurable interest, which is a vital component of many insurance policies. A clear understanding of who has a financial stake in the insured property is essential for a successful claim.

- Incorrect application of policy exclusions: Study policy exclusions carefully and apply them accurately. A wrong interpretation can lead to inaccurate assessments. Understanding the nuances of these exclusions will avoid costly mistakes.

Key Concepts and Principles

Yo, future insurance pros! Grab your kopi and get ready to dive into the core concepts of property and casualty insurance. Understanding these fundamentals is key to acing the exam and, more importantly, being a total boss in the insurance game.These core concepts are like the building blocks of the whole insurance world. Knowing ’em will make everything else way easier to understand.

Think of it as learning the alphabet before you start reading a novel – you need those basics!

Core Concepts of Property and Casualty Insurance

Property and casualty insurance, basically, protects people and businesses from financial losses due to various events. It’s about transferring risk from individuals and companies to insurance providers. This helps everyone sleep better at night, knowing they’re covered.

Types of Insurance Policies

Different types of policies cater to different needs. Some are specific to homes, others to cars, and others to businesses. Knowing which policy fits your situation is crucial.

- Homeowners Insurance: Covers your house, belongings, and potential liability if someone gets hurt on your property. Think of it as a safety net for your biggest investment.

- Auto Insurance: Protects you if you’re involved in an accident, covering damages to your car and others. It’s the law in most places, and it’s your best friend when things go sideways.

- Business Insurance: A broad category that includes various policies designed to cover business risks, from property damage to liability issues. Essential for any entrepreneur, to protect their hard work.

Key Differences Between Property, Liability, and Casualty Insurance, P&c insurance exam prep

Understanding the differences between these three types of insurance is like understanding the difference between a banana and a mango. They’re all fruit, but they have distinct characteristics.

| Insurance Type | Description | Example |

|---|---|---|

| Property Insurance | Covers damage to your property (like your house or car) due to events like fire, storms, or vandalism. | Your house burns down, and your insurance covers the rebuilding costs. |

| Liability Insurance | Protects you from financial responsibility if you cause harm or damage to someone else. | You accidentally damage your neighbor’s car while parking, and your liability insurance covers the damages. |

| Casualty Insurance | Covers losses or injuries resulting from accidents or other unforeseen events. This is a broader category, often encompassing property and liability. | Someone slips and falls on your property, and your casualty insurance covers their medical bills. |

Insurance Industry Trends and Developments

Nihon, the insurance industry’s been goin’ through some major changes lately, man. From digital disruption to regulatory shifts, it’s a wild ride. Understanding these trends is crucial for acing the P&C exam. This stuff is gonna be on the test, so you better pay attention.The P&C insurance game is evolving fast, and these changes are significantly impacting how the industry operates and what’s tested on the exam.

New technologies, shifting customer expectations, and regulatory updates are all shaping the future of insurance.

Latest Trends and Developments

The insurance sector is embracing digital transformation at a rapid pace. This includes everything from mobile apps for claims filing to AI-powered underwriting. Insurers are also focusing on personalized services and proactive risk management to stay competitive. Expect to see more data analytics and predictive modeling used for pricing and risk assessment.

Impact on Exam Content

These trends will likely show up in the exam questions. Expect questions related to digital platforms, data analytics, and the use of AI in underwriting, claims processing, and customer service. You gotta know how these new technologies are changing the way policies are sold, claims are handled, and risks are evaluated.

Preparing for the P&C insurance exam can be challenging, requiring significant dedication. Knowing the travel time between cities like Perth and Hobart, for example, Perth to Hobart flight time , can help in better planning study breaks and time management strategies. Ultimately, focusing on the exam’s key concepts and dedicated practice questions is crucial for success.

Emerging Technologies

The use of AI, machine learning, and big data analytics is revolutionizing insurance operations. AI algorithms can analyze massive datasets to identify patterns, assess risk more accurately, and even automate some tasks. This leads to more efficient processes and potentially lower premiums for customers.

- AI-powered risk assessment: Algorithms can analyze driver behavior, home security systems, and other data to assess risk more precisely. This allows for customized pricing and better risk management strategies. For example, some companies now use data from connected car devices to provide tailored insurance premiums based on driving habits.

- Chatbots and virtual assistants: These tools are becoming increasingly common for answering customer inquiries, processing claims, and providing general information. This improves customer service and efficiency.

- Blockchain technology: Blockchain has the potential to enhance the security and transparency of insurance transactions, especially for complex claims.

Regulatory Changes

Regulations are evolving to address the challenges and opportunities presented by these new technologies and the need for consumer protection. Insurers need to be well-versed in these changes. Expect questions about compliance and the evolving regulatory landscape in the exam.

- Data privacy regulations: Regulations like GDPR and CCPA are impacting how insurers collect, use, and share customer data. This means that insurers must adhere to strict data privacy protocols, which could affect the exam’s focus on policy provisions.

- Cybersecurity regulations: Cybersecurity is a critical concern for insurers, especially with the increasing reliance on digital systems. Regulatory changes are emerging to address this, and this is a growing area of importance in the industry.

Epilogue

In conclusion, conquering the P&C insurance exam requires a multifaceted approach. This guide has provided a roadmap, outlining essential study resources, effective learning strategies, and practical tips for time management. By combining thorough preparation with a proactive and focused approach, you’ll confidently navigate the exam and embark on a successful insurance career. Remember to practice consistently, stay motivated, and leverage the resources available to you.

Your dedication to this process will undoubtedly pay off handsomely.

FAQ Summary

What are some common mistakes candidates make during the P&C insurance exam preparation?

Procrastination, insufficient practice with mock exams, and neglecting key concepts are common pitfalls. Failing to prioritize effectively, lacking a structured study schedule, and not seeking clarification on confusing topics can also lead to weaker performance.

How can I best utilize practice questions for identifying my weak areas?

Carefully analyze each question you get wrong. Identify the specific concepts or areas where you struggled. Review the relevant sections of your study materials and seek clarification on any remaining doubts. Regular practice will help reinforce your understanding and pinpoint weaknesses.

What are the most important factors for effective time management during the study process?

Creating a realistic study schedule, prioritizing tasks, and allocating sufficient time for each topic are crucial. Regular breaks, maintaining a healthy lifestyle, and avoiding distractions are also essential components of effective time management.

What emerging technologies are impacting the P&C insurance sector?

Automation, data analytics, and digital platforms are rapidly changing the landscape of the P&C insurance industry. These advancements are impacting everything from policy processing to risk assessment and claims handling, and the exam reflects these changes.